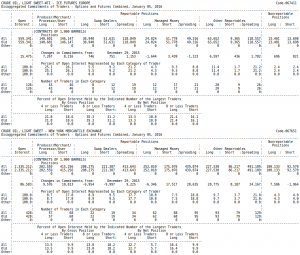

To be honest they have actually reduced their short position by some 30% since October when price was in the $45-50 range. That probably generated some cashflow for the books, but still a 8 billion dollar short position in oil. Why?

Well.The only explanation is that they must be absolutely certain that the probabilities of oil hitting $25 is bigger than hitting $45 again. 8 billion however must be compared to the $40 billion short position they had in the $90 range.

For the perspective, here is todays fresh low in oil – $30.88 .

So. Where is the LENR included long term resistance of the oil price on the down side? Well I believe I predicted the $20-$30 range two years ago, and I believe this is what we’re going to see during 2016. There is “War” risk that could trigger price upwards, but it has to be physical (i.e. real bombs on Saudi resources), not like the recent Saudi/Iran issue. However, if LENR gets real mainstream media momentum when verified proof of the 1MW E-Cat in Florida is released in march, then $10 is possible. Only Mid East oil producers can handle that so from there on its all about Aramco.

Actually I think this scenario is interesting, and since I do not think the Saudis and their McKinsey advisors are completely stupid 🙂 I believe this is in their plan. Oil will be useful for a long time and Aramco will have ~100% market share, and the market will stabilize since the migratíon to LENR in transportation will take time. Their assets are also in refining and other upstream activities which are valuable even with LENR enabled synthetic fuels. And then of course they need the cash NOW to avoid serious domestic troubles – An IPO is a brilliant idea.

Hi all

So I was 2 weeks out in my prediction of $30 for the end of 2015, though my latter prediction that Oil could reach $30 in October was a bust. A contact told me that an LENR competitor to Rossi were to release in October and that others were to make national announcements, those things happened but over a longer time frame and in one case not the company I expected.

Torkel was predicting the same $30 range though I am not sure what time frame he specified and of course he predicted the $30 price first. I was too conservative in first prediction of around $70 in the first phase of the effect of LENR back in 2013 but I was only around $10 out.

Torkel’s predictions are more technical and about position. My predictions were more based on analysis of business strategy indicators. It would surprise many of you how often people at the top set prices and achieve them according to human timelines while ignoring the markets technical effects. Of course this only works when those doing it are working with the flow of the market’s technical influences and is the reason why they pay people like Torkel large amounts of money for their expertise 😉

I have made clear I am in agreement with Torkel that Oil will drop to $10 in 2016, in fact I think the Saudi’s for strategic reasons may push it to below $5 to kill off as many of the competitors as they can now and to slow the take up of LENR, it is what I would do. And Saudi Arabia has the pockets to do it. They know their long term profits rely on maximising market share as early as possible, before competitors can use LENR to cut production costs and may be rescue their wells.

As Torkel says a war could increase the price but it is not in the Saudi or Iranians interest to do that, the Russians Chinese and the West would just come along and take their toys away.

I think the reason banks are no longer pushing the short position so hard is the strategic one that there is not as much of a profit in it, and if LENR is about to take off; then it is time to have the cash ready for investing in LENR enabled industry. So the next major switch is Long positions in LENR enabled markets and investing in the boom.

With the cash the short players have made, they are in the perfect position to buy a big chunk of the LENR future. I would expect moves to energy dependent products and new technology that requires high energy, such as the aerospace industry. Robotics such as Google’s purchase of Boston Dynamics. Their Petman and other robots need a low weight high power energy supply and LENR fits the product perfectly. Drones of all kinds and that drone passenger car would be well worth a punt. Satellite launches will get very cheap, so investing in Satellite companies should see a boost.

Just some hints as to where I will be researching.

Kind Regards walker