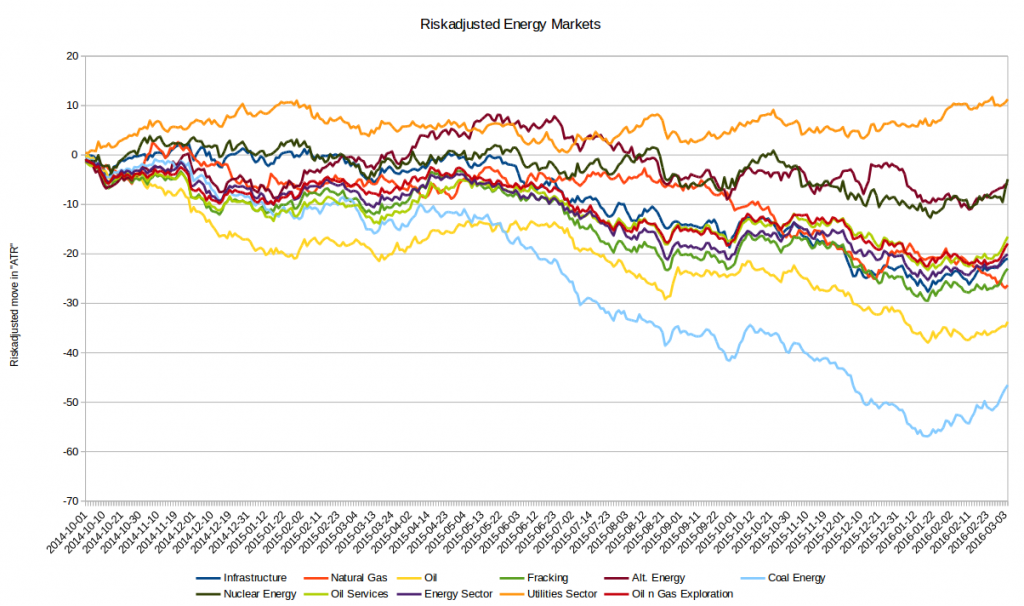

Looking at the different aspects of the energy market since october 2014 (the Lugano Report) we can see that the by far worst performer (risk adjusted) has been coal energy, followed the plunging oil price. The utilities sector has outperformed everyone else actually showing a positive trend.

In between we have nuclear and alternative energy outperforming fossil fuels.

But why?

My take is that the markets on average has not yet realized that with LENR producing electricity big expensive solar farms will have no future. And probably, even more important; the “big money” has never been in solar, so they have not been selling, like they’ve done in oil, coal and gas during the last 18 months.

So I figure that there is a trade here shorting solar on a 6-12 month basis, buying cheap out of the money put options in companies like First Solar ($FSLR) and SunPower ($SPWR).

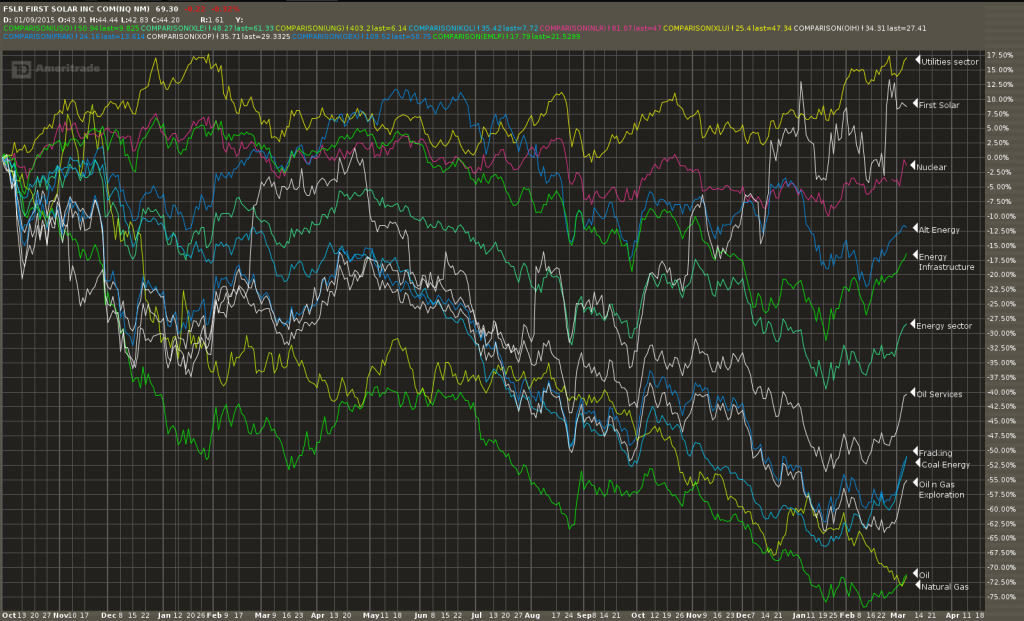

Looking at First Solar as an example below, we can see it has almost performed as well as the utilitiy sector since the Lugano Report. That doesn’t make sense to me. If LENR and E-Cat is for real, which I sincerely believe, they will most probably be affected negatively, maybe becoming more or less worthless.

The utility sector will on the other hand have a great future since we will use a lot more energy in the future and they will not charge us for the energy per se (kWh) but for the bandwidth and transport. Most of us will certainly be connected to the “smart” grid in the future and we will pay for it. So I’m long utilities (XLU).

Of course this is not investment advise, only a report on the investments I made myself.

fashion renewable (to oppose with old fashioned hydro & alike) will react very differently from fossil fuel.

Today renewable have a present based on fashion and subsidies.

Some , surfing on the fashion, imagine it have a future, but in that ideology it is a rational bet.

Fossil fuel have a brilliant present, even if expensive oil is maybe not yet valuable if OPEC stop behaving like a cartel.

The fashion says it have no future because of divestment for climate, and renewable competition. In the context of current ideology Fossil are energy of the present, with no future. In the context of no-LENR no-renewable nuke-fear ideology, fossil will grow in consumption and then price.

Now if you introduce LENR there are two things that I consider :

first in the context of fashion ideology, renewable will lost its status of “energy of the future”, and probably will lose quickly it’s subsidies. It is immediately definitively dead.

This is the same for nuke, even for the “not-fear-mongered”, for which nuke is a long term 60 year investment, with huge investment and huge political risk.

In that context fossil fuel are a perfect “energy for the transition”, while we dump renewable, close the nuke, and develop working LENR technology (20 years to develop a car, 30-40 for a plane?), even f at the end LENR will allow synfuel, and LENR-assisted tight-oil-extraction.

Now if renewable ARE ALREADY ZOMBIE like Kodak film, the associated companies could make a Fujifilm pivoting, exploiting their technology and competence.

Waste heat recuperation companies, like Exoes could pivot to make generators, CHP, for building, district, vehicles or devices.

Smart grid companies could propose a smart grid model, based on energy abundance instead of energy scarcity (Uberpop/BlaBlacar energy).

PV semiconductor companies could move to nanotechnology and develop LENr materials and science.

I’m less optimistic for wind turbines, but mayeb they could pivot to distric sized generators, off-shore technology, sky-station, public infrastructures…

some green business companies may simply pivot to something we don’t even imagine, like in tourism, …

if you should short something, I don’t think it should be oil companies.

As you say renewable companies, if they don’t pivot efficiently, will die.

I am very concerned also about public policies, because like in geopoliti public authorities have a strong tendency to keep remanent targets and protect economic rents, and obsolete technology.

Agreed!

In a LENR context I believe solar is doomed. Of course some may reinvent, but most will not. Wind as well, but I did not find any really good wind focused companies to short, most are partly utilities, which I believe have a great future since we’re going to use a lot more energy in the future.

As you say I dont like the idea to short oil companies. These are filled with smart money and have allready divested risky assets. They make money och logistics and distribution and will probably continue to do so in a foreseable future. They will user their infrastructure for cheaper oil and new cheap LENR based biofuels. The combustion engines will live on for many years, but gradually beeing replaced by LENR/battery based technologies.

Pingback: Using the Twitter Fire Hose Feed to follow #LENR | Sifferkoll®

Hello,

I think that some old “traditional” companies may see a large improvement of their revenue thanks to LENR.

Given the switch from carbon/oil to electric, given the need of new plants to produce/transform/use additional electric energy, I imagine companies like Siemens, ABB, WhiteWestinghouse, GE may be helped a lot.

What’s the opinion of Sifferkoll readers?

Regards

Sandro