Reading the BIS pressrelease from yesterday (June 28th) i found some interesting comments on the oilprice that sort of fits into the overall BigBank plan. (BIS/Bank for International Settlements) beeing the mother of all BigBank institutions …

No doubt they are planning for lower oil prices AND further QE (ie. Monetary policy), but are healthy enough to realize that unless there are price deflation from lower energy costs the increase of debts will not work in their favour but only lead to instabilities (see Greece).

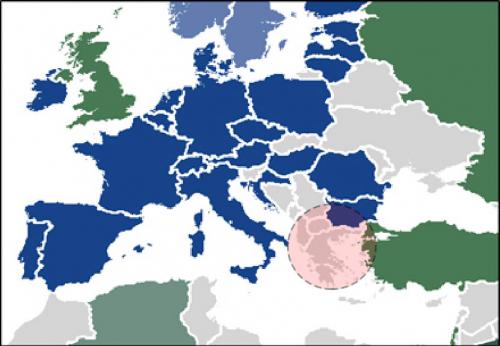

Maybe they’ve already given up on Greece as shown in this Freudian slip found by WSJ according to Zerohedge. In the final report at the bis.org web Greece us blue again … Coincidence or plan?